Jackpotting: The Alarming Surge of ATM Hacking Across America

The Alarming Surge of ATM Hacking Across America

Automatic Teller Machines (ATMs) have always been a magnet for criminals. Back in the 1980s, thieves had a crude but somewhat effective method: they’d chain ATMs to their trucks and haul them away to crack open at their leisure. Banks, however, caught on and started bolting ATMs to the ground with massive steel rods, leaving behind more than a few truck bumpers at the scene of failed heists.

The Evolution of ATM Attacks

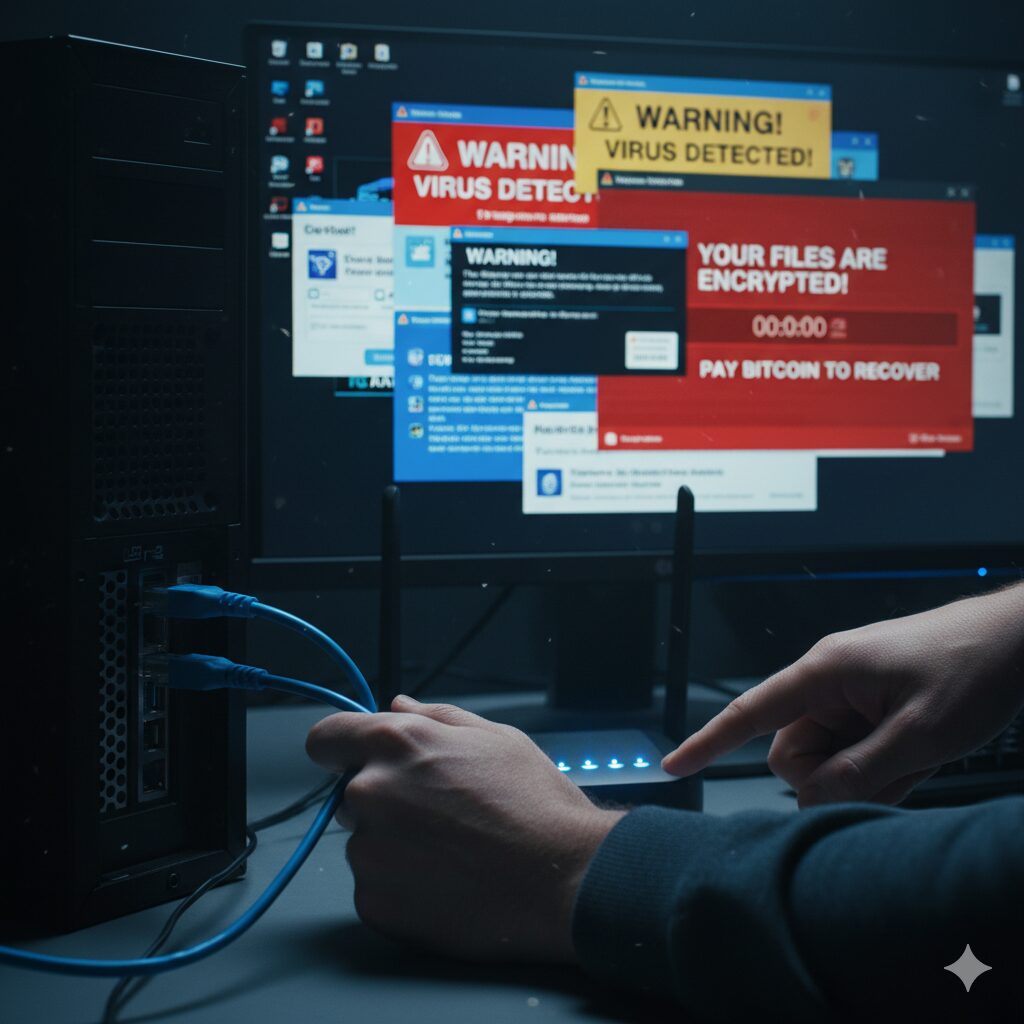

Fast forward to today, and hackers have upped their game with a more sophisticated method known as ‘jackpotting’. This technique involves hacking into the ATM’s system to force it to dispense all its cash, essentially turning the machine into a jackpot for the criminals. This method is not only more lucrative but also less conspicuous than the brute-force methods of the past.

Jackpotting attacks typically involve two main steps. First, the hackers gain physical access to the ATM, often by posing as technicians. They then connect a device to the ATM’s computer, which allows them to install malware or manipulate the system directly. Once the malware is in place, the ATM is essentially under the hackers’ control, and they can force it to dispense cash on demand.

The Rise of Jackpotting in the US

While jackpotting has been a known threat in Europe and Asia for some time, it has only recently started to gain traction in the US. The first major reported incident occurred in 2018, and since then, the frequency of such attacks has been steadily increasing. This rise can be attributed to several factors, including the increasing sophistication of hacking tools and the high potential payout.

One of the most concerning aspects of jackpotting is its potential for widespread damage. Unlike traditional ATM theft, which typically affects a single machine, jackpotting can be used to target multiple ATMs simultaneously. This is because the malware used in these attacks can be remotely controlled, allowing hackers to coordinate attacks across a wide geographic area.

Combating the Threat

Banks and law enforcement agencies are not taking this threat lightly. They are continually updating their security measures to stay one step ahead of the hackers. This includes the use of advanced encryption techniques, real-time monitoring systems, and even physical security enhancements.

However, the fight against jackpotting is not just the responsibility of banks and law enforcement. ATM users can also play a role by being vigilant and reporting any suspicious activity. For instance, if an ATM looks like it has been tampered with, or if there are individuals loitering around the machine, it’s best to avoid using it and report it to the bank immediately.

Moreover, banks are investing in educating their customers about the risks of jackpotting and the importance of using ATMs in safe, well-lit locations. They are also encouraging customers to use ATMs located inside bank branches, which are generally more secure than standalone machines.

The Future of ATM Security

The rise of jackpotting has highlighted the need for continuous innovation in ATM security. As hackers become more sophisticated, so too must the measures designed to thwart them. This includes not only technological solutions but also a greater emphasis on physical security and customer education.

In conclusion, while the threat of jackpotting is very real and growing, it is not insurmountable. By staying informed, being vigilant, and working together, banks, law enforcement, and customers can help to mitigate this risk and ensure the continued safety and security of our financial systems.

For more information on ATM security and the latest threats, you can visit the FBI’s website.