GRC – Governance, Risk, Compliance

What is GRC?

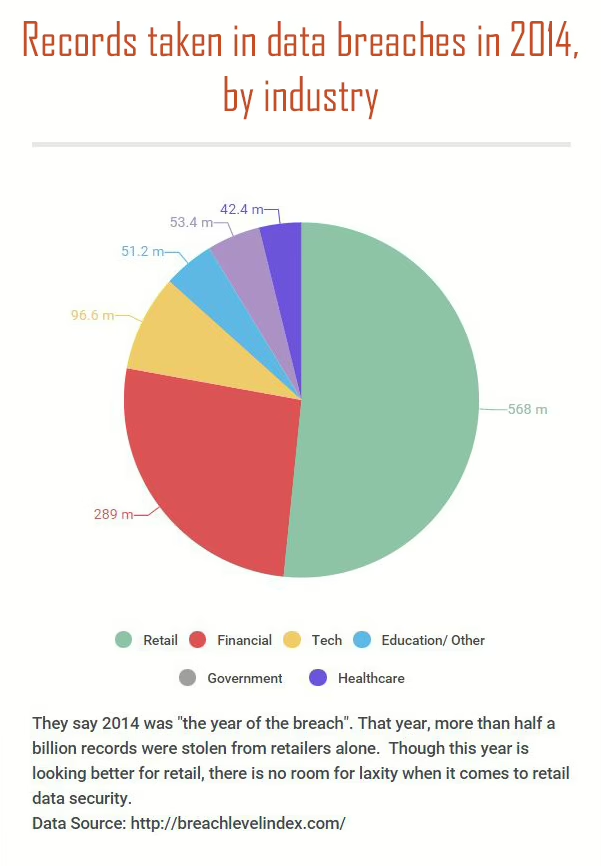

Security issues such as data breaches and cyber risks can lead to loss of your sensitive data, financial losses and damage to your reputation. Therefore, institutions need a comprehensive, integrated and sustainable framework to effectively manage these risks. GRC (Governance, Risk, Compliance); It is a holistic management approach that covers governance, risk management and compliance processes.

Solution Modules

Modern GRC platforms allow institutions to manage their risks, processes and compliance needs in different areas in an integrated manner. Commonly offered modules are:

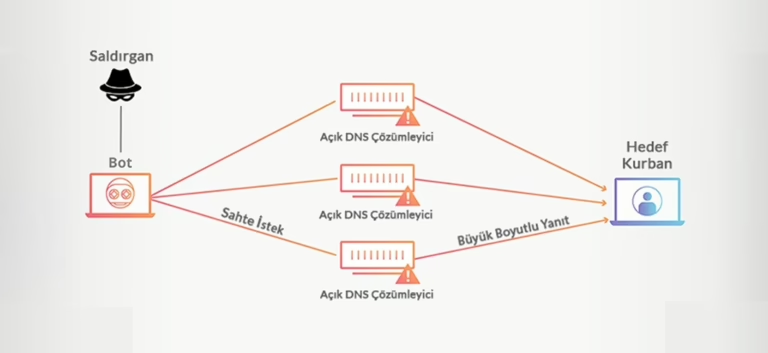

IT and Security Risk Management: It helps develop a comprehensive view of your organization’s risk posture and manage your security risks through practices such as risk assessment, incident management, compliance management and reporting.

Audit Management: Provides a centralized platform to manage all aspects of the audit process more efficiently and effectively, from audit planning and programming to execution and reporting. It harmonizes your audit function within the framework of risk and compliance management.

Third Party Management: It helps your organization streamline third-party management processes, improve collaboration between stakeholders, and increase the overall effectiveness of third-party management programs.

Business Flexibility and Operational Durability: Business flexibility and operational resilience is your organization’s ability to maintain core business functions and services during and after an outage. This involves implementing plans to ensure business continuity in the face of disruptions. It offers a variety of tools and features that support business flexibility and operational durability. These; These are applications such as business impact analysis (BIA), crisis management, incident management, business continuity planning (BCP), crisis recovery planning (DRP), supplier risk management and risk assessments.

Regulatory and Corporate Compliance: Allows your business operations to develop policies and procedures to ensure compliance with applicable legal requirements and industry standards. It helps you manage these relevant standards and regulations (COBIT, ITIL, ISO 27001, PCI/DSS, CBDDO) through implementation and monitor your compliance status.

Enterprise and Operational Risk Management: Modern GRC platforms help you make informed decisions by identifying, assessing and mitigating risks in your operations.

ESG (ESG-Environment, Social, Governance) Management: It includes ESG management features that help your organization monitor and measure sustainability initiatives, ethical standards, and regulatory compliance procedures.

Benefits Offered by GRC Service

In conclusion GRC offers a strategic structure that strengthens compliance and governance while keeping institutions’ risks under control. An integrated GRC structure makes institutions’ processes more effective, measurable and sustainable. In this way, organizations both increase their security and build their operations on a more solid foundation.